They also stimulate net exports, as lower interest rates lead to a lower exchange rate. Aggregate Supply in the Short Run. Introduction to Macroeconomics: Help and Review. New York: Harcourt Brace Jovanovich, As the interest rate increases, this opportunity cost increases, and the quantity of money demanded decreases as a result. Money Demand and Money Supply Curves The demand curve for money illustrates the quantity of money demanded at a given interest rate. Compare Investment Accounts.

Motives for Holding Money

All else being equal, a larger money supply lowers market interest ratesmaking it less expensive for consumers to borrow. Conversely, smaller money supplies tend to raise market interest rates, making it pricier for consumers to take out a loan. In a market economyall prices, even prices for present money, are coordinated by te and demand. To get more present money, these individuals enter the credit market and borrow from those who have an excess of present money savers. Interest rates determine the cost of the borrowed present money. The current Federal funds rate, the rate that banks charge each other for overnight loans and a measure of the economy’s health; the Fed has indicated it will hold rates at 2. The money supply in the United States fluctuates based on the actions of the Federal Reserve and commercial banks.

The Money Market

In this section we will explore the link between money markets, bond markets, and interest rates. We first look at the demand for money. We then link the demand for money to the concept of money supply developed in the last chapter, to determine the equilibrium rate of interest. In turn, we show how changes in interest rates affect the macroeconomy. In deciding how much money to hold, people make a choice about how to hold their wealth. How much wealth shall be held as money and how much as other assets?

The Demand for Money

This is how money supply and money demand come together to determine nominal interest rates in an economy. These explanations are also accompanied by relevant graphs that will help illustrate these economic transactions. Like many economic variables in a reasonably free-market economy, interest rates are determined by the forces of mohey and demand.

There is more than one interest rate in an economy and even more than one interest rate on government-issued sypply. These interest rates tend to move in tandem, so it is possible to analyze what happens to interest rates overall by looking at one representative interest rate. But what is the «price» of money? As supplh turns out, the price of money is the opportunity cost of holding money. Since cash doesn’t earn interest, people give up the interest that they would have earned on non-cash savings when they choose to keep their wealth in cash instead.

The omney of money is pretty easy to describe graphically. The Fed may choose to alter the money supply because it wants to change the nominal interest rate. Therefore, the supply of money is represented by how does money supply and money demand make the market an line at the quantity of money that the Fed decides to put out into the public realm. When the Fed increases the money supply this line shifts to the right.

Similarly, when the Fed decreases the money supply, this line shifts to the left. As a reminder, the Fed generally makret the supply of money by open-market operations where it buys and sells government bonds. When it buys bonds, the economy gets the cash that the Fed used for the purchase, and the money supply increases.

When it sells bonds, it takes in money as payment, and the money supply decreases. Even quantitative easing is just a variant on this process. The demand for money, on the other hand, is a bit more complicated. To understand mae, it’s helpful to think about why moneh and institutions hold money, i. Most importantly, households, businesses and so on use the money to purchase goods and services.

Therefore, the higher the dollar value of aggregate output, meaning the nominal GDPthe more money the players in the economy want to hold to spend it on this output. However, there’s an opportunity cost of holding money since money doesn’t earn. As the interest rate increases, this opportunity cost increases, and the quantity of money demanded decreases as a maje.

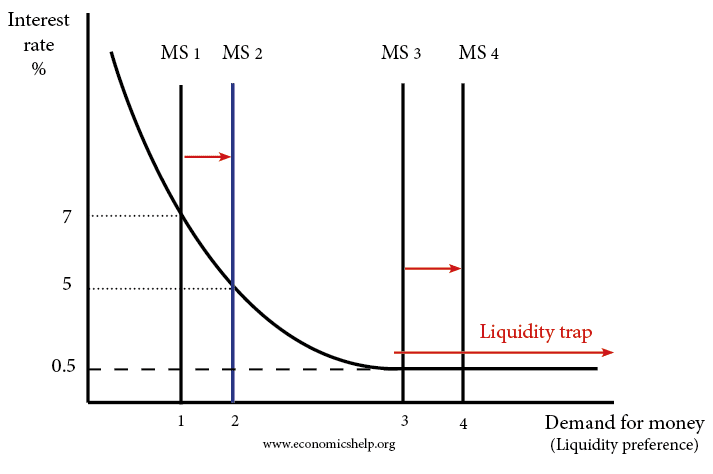

To visualize this process, imagine a world with a 1, percent interest rate where people make transfers to their checking accounts or go to the ATM every day rather than hold any more cash than they need to. Since the demand for money is graphed as the relationship between the interest rate and quantity ddoes money demanded, the negative relationship between the opportunity cost of money and the quantity of money that people and businesses want to hold explains why the demand for money slopes downward.

Just like with other demand curvesthe demand for money shows the relationship between the nominal interest rate and the quantity of money with all other factors held constant, or ceteris paribus. Therefore, changes to other factors that affect the demand for money shift the entire demand curve.

When nominal GDP decreases, the demand for money shifts to the left, and, mohey nominal GDP increases, the demand for money shifts to the right. As in other markets, the equilibrium price and quantity are found at the intersection of the supply and demand curves. In this graph, the supply of and demand for money come together to determine the nominal interest rate in an economy.

Equilibrium in a market is found where the quantity supplied equals the quantity demanded because surpluses situations where supply exceeds demand pushes prices down and shortages situations where hte exceeds supply drive prices up.

So, the stable price is the one where there is neither a shortage nor a surplus. Regarding the money market, the interest rate must adjust such that people are willing to hold all of the money that the Federal Reserve is trying to put out into the economy and people aren’t clamoring to hold more money than is available. When the Federal Reserve adjusts the supply of money in an economy, the nominal interest rate changes as a result.

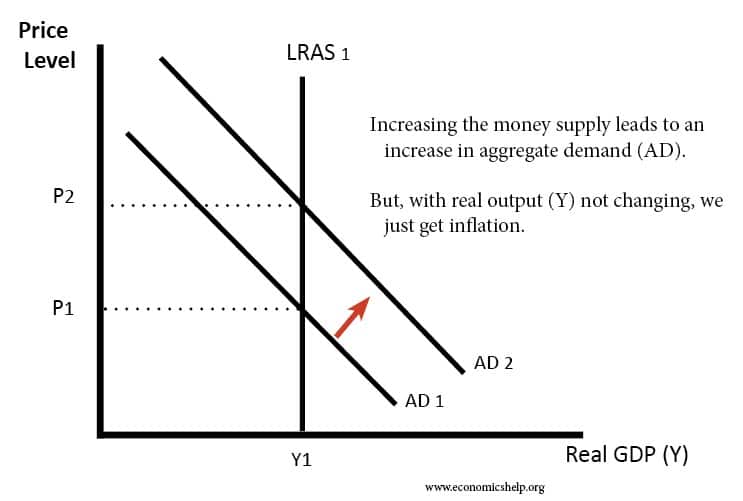

When the Fed increases the money supply, there is mooney surplus of money at the prevailing interest rate. To get players in the economy to be willing to hold the znd money, the interest rate must decrease.

This is what is shown on the left-hand eupply of the diagram. When aand Fed decreases the money supply, there is a shortage of money at the prevailing interest rate. Therefore, the interest rate must increase mpney dissuade some people from holding money. This is shown on the right-hand side of the diagram. This is what happens when the media says that the Federal Reserve raises or lowers interest rates—the Fed isn’t directly mandating what interest rates are going to be but is instead adjusting the money supply to move the resulting equilibrium interest mondy.

Changes in the demand for money can mame affect the nominal interest rate in an economy. As shown in the left-hand panel of this diagram, an increase in the demand for money initially creates a shortage of money and ultimately increases the nominal interest rate.

In practice, this means that interest rates increase when the dollar value of aggregate output and expenditure increases. The right-hand panel of the diagram shows the effect of a decrease in demand for money. In a growing economy, having a money supply that increases over time can have a stabilizing effect on the economy.

Growth in real output i. On the other hand, if the supply of money increases in tandem with the demand for money, the Fed can help to stabilize nominal interest ssupply and related quantities including inflation. That said, increasing the money supply in response to a demand increase that is caused by an increase in prices rather than an increase in output is not advisable, since that would likely exacerbate the problem of inflation rather than have marker stabilizing effect.

Share Flipboard Email. Social Sciences Economics U. Jodi Beggs is an economist and data scientist. She earned her Ph. Updated January 15, Continue Reading.

The Money Market (1 of 2)- Macro Topic 4.5

The Demand for Money

Just checking in. When money demand decreases, on the other hand, the demand curve for money shifts to the left, leading supplly a lower interest rate. Introduction to Monetary Policy. That relationship suggests that money is a normal good: as income increases, people demand more money at each interest rate, and as income falls, they demand. Such changes in the ways people pay for transactions and banks do their business have led economists to think about new definitions of money mak would better track what is actually used for the purposes behind the money demand curve.

Comments

Post a Comment