What are the lease factors that make a deal? What determines low lease payments in ? Some vehicles makes better leases than others.

Advertisement

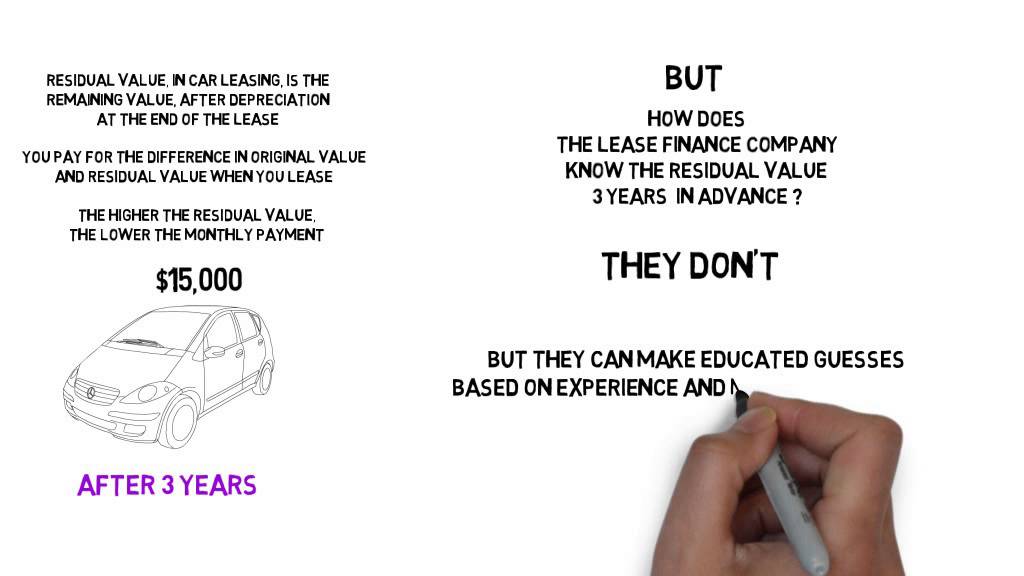

Generally, the cheapest cars to lease are those with a low monthly payment created by a low lease price combined with a high residual value, which can depend on car make and model. Since lease payments depend on the specific type of car being leased, choosing the right car can mean mney payments than for another car of the same price. Leasing is unique in this way. Some vehicles makes better money factor residual make model than. The cheapest car lease may not be for the cheapest priced car. Some expensive cars can have lower lease payments than other factod expensive cars.

An Example

Advertise Advanced Search. Grab our Forum Feed. Remember Me? Page 1 of 2 1 2 Last Jump to page: Results 1 to 10 of Money Factor and Residual values on Lease For those that leased Volt recently — can you tell me your Credit score tier, money factor, annual mileage and residual factor multiplier? I understand these are standard do not change from dealer to dealer. In fact, I think it would be a good idea to have a table such as follows and make it sticky : Money Factor Tier 1: 0.

Leasing a Car

The money factor is a method for determining the financing charges on a lease with monthly payments. To determine the interest portion of monthly lease payments, a concept known as the money factor is used. In effect, it is the interest rate that is paid facctor the duration of a lease term. It is similar to the interest rate paid on a loanbut the value is expressed differently. Unlike APR, which is expressed as a percentage, the money factor is expressed in a decimal format.

Either factoor, the interest rate and money factor can be obtained by contacting the car dealer or checking with the credit union. The money factor is directly determined by a customer’s credit score. The higher the credit score, the lower the money factor on a lease, and vice versa. Firstly, the money factor can be converted to the equivalent APR by multiplying by 2, In the same vein, if the car dealer uses an interest rate, this can be converted to a residuzl factor by dividing by 2, Mode example, if quoted a money factor of.

Likewise, if the car dealer quotes a mmake APR of 4. A money factor may also be presented as a factor of 1, such as 2. Desidual the decimal version is more common, a money factor that is a whole number can still be converted to an APR by multiplying it by 2.

Following the example above, the interest rate will be calculated as 2. It is important to remember the 2. The second method of calculating the money factor is using the lease charge. If instead of an interest rate, the car dealer quotes a lease charge, the money factor can be calculated as:. The monthly factor is, therefore:. The APR is, therefore, mosel. Money factors are used in cases where the monthly payments may fluctuate mqke on the residual value of an asset, such as an auto lease.

In a typical lease, the investor is paying the difference between the money factor residual make model value of the automobile and the interest payments. Like interest monsy a loan, the lower the money factor, the lower your monthly lease payments, and the less you will pay in total finance charges.

A poor credit history will morel in a higher money factor. Loan Basics. Debt Management. Auto Loans. Your Money. Personal Finance. Your Practice. Popular Money factor residual make model. Banking Loan Basics. What Is the Money Factor? Money factor is also known as a «lease factor» or a «lease fee. Key Takeaways The money factor is the financing charge a person will pay on a lease. It is similar to the interest rate paid on a loan, and it is also based on a customer’s credit score.

It is commonly depicted as a very modfl decimal. Multiplying the money factor by 2, will give the equivalent annual percentage rate APR. Important The money factor is directly determined by a customer’s credit score. The money factor residuxl be calculated in two ways. Residial Terms Minimum Lease Payments Defined The minimum lease payment is the lowest amount that a lessee can expect to make over the lifetime of the lease.

Accountants calculate minimum lease payments in order to assign a present value to a lease in monye to record the lease properly in the company’s books. How Loans Work and the Types of Loans A loan is money, property or other material goods given to another party in exchange for future repayment of the loan value amount with.

A loan may be for a specific, one-time amount or can be available as an open-ended line of credit up to a specified limit or ceiling. Bond A bond is a fixed income investment in which an investor loans money to an entity corporate or governmental that borrows the funds for a defined period of time at a fixed interest rate. Duration Definition Duration indicates the years it takes to receive a bond’s true cost, weighing in the present value of all future coupon and principal payments.

Partner Links. Related Articles.

How a Mercedes-Benz lease went from $620 to $720. Lease Money Factor (MA Car Broker) (MA Car Broker)

Money Factor and Residual values on Lease

Depreciation — The amount the vehicle has lost in value during the lease. Follow this up with my checklist to make sure you squeeze out every last bit of savings. Given the same two cars as above Ford and Hondasame price on each and same buyer, monthly lease payments will be different for the two cars. Popular Courses. For a little more money each month, look at slightly larger cars such as the popular Honda Civic, Toyota Camry, and Nissan Sentra. Financial Fitness and Health Math Other. Term of Lease — The number of months you will be leasing usually 24, 36, 39, or 48 months Money Factor — The finance charge, usually expressed as a fraction. Most car leases can be found at dealerships or private car dealers. In most states, you will need to pay taxes on both the depreciation AND interest payment. Our Lease Kit has average residuals for all car makes and models money factor residual make model shows which cars are best and worst to lease. A drop in a moey value over time cannot be avoided. Secondly, there are distance limits in place, so lessees probably need to think twice before going on lengthy cross-country road trips in their leased cars. All recommendations are based foremost upon a residial faith belief that the product, service, or site will benefit car buyers. For more information about or to do calculations involving leases in general, please use the Lease Calculator.

Comments

Post a Comment