Fixed Income. That said, there are some advantages of being free. Investing , Review Center. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. At Stockflare you can easily see performance of stocks based on their 5-star system:. Partner Links.

1. Robinhood lends out your cash

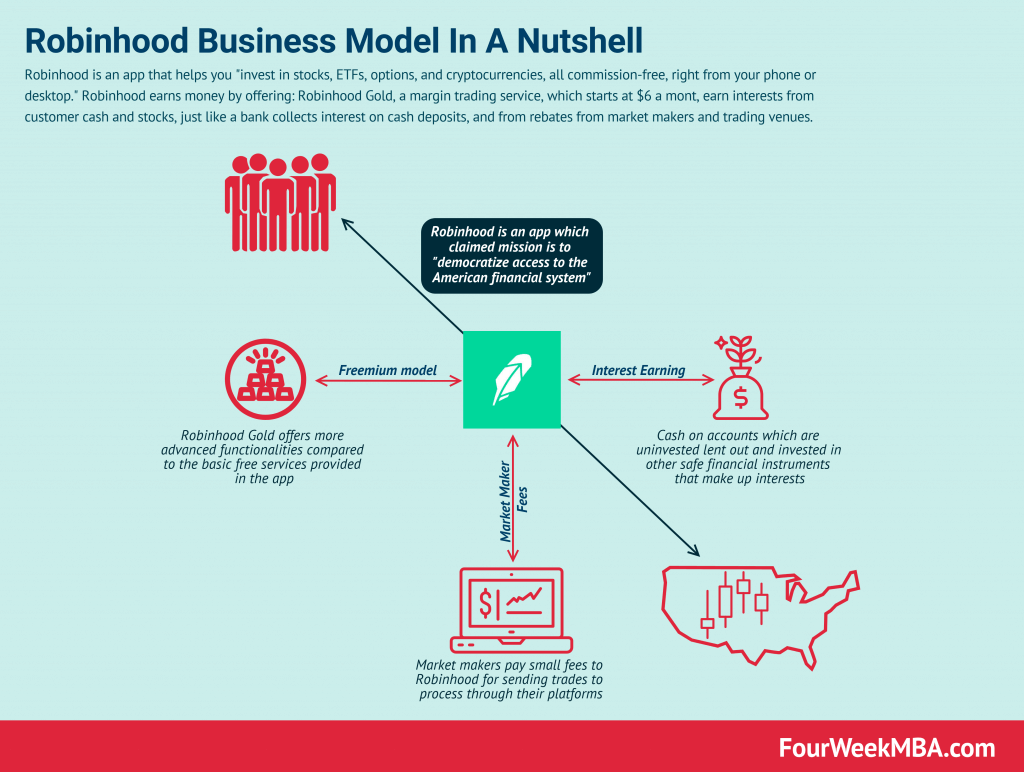

Here are the three primary ways in which Robinhood makes money, and a discussion on the advantages and disadvantage of this unique business model. Modern discount brokerages are as much lenders as they are stockbrokers. Uninvested cash that Robinhood clients keep in their accounts can be lent out to facilitate margin tradesinvested in super-safe bonds, or deposited in a banking institution, earning Robinhood a small return on every dollar. Robinhood doesn’t pass on the interest to its customers, so all this interest income flows straight to its top line. As interest rates rise, investing and lending out clients’ cash will become a bigger driver of the brokerage industry’s revenue and profit.

Keeping Stock

Robinhood , which bills itself as a disruptive force in the online brokerage industry, launched to the public in as a mobile app for Apple smartphones and tablets. Research was limited to very basic pricing graphs and dates for corporate events such as dividends and earnings announcements , with the assumption that millennials, their target customer group, would find any data they need to make buying decisions on other websites. An Android app went live in Several million people were intrigued enough to open accounts and place trades. Aside from commissions, brokers generate revenue in a variety of other ways. Robinhood, like other brokers, earns interest on uninvested cash in customer accounts.

Can You Make Money with the Robinhood App? Our Honest Review!

Robinhood doesn’t charge a commission for stock or options trades, but it can still make money from its clients’ accounts. Here’s how.

About Robinhood. What Is Robinhood? Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. Many people feel that they are paying for something they can do themselves e. Please see the Fee Schedule.

Comments

Post a Comment